The Analysis: Mizen

📊 Banking that’s halal and hassle-free? Mizen is rewriting finance in Europe—let’s dive in! 🌟

Today, we’re diving into Mizen’s equity crowdfunding campaign, now live on Republic Europe. Expect a 7-minute read, and please note this is not financial advice.

Founding Team 👨🏼💻

Hichem Metatla, CEO & Co-Founder: Hichem began his career in banking, holding roles like Vice President at EFG Bank, where he structured complex financing deals for HNWIs and corporates, and as a Risk Analyst at BNP Paribas. Transitioning to entrepreneurship, he founded Western Switzerland’s first equity crowdfunding platform and Bee Invested, an innovation consultancy.

Abdelwaheb Rahmouni, CTO & Co-founder: Abdelwaheb brings over a decade of experience in IT strategy and digital transformation. Before Mizen, he held leadership roles such as Track Lead at Rakuten Europe and Manager at Mob&TIC. He also contributed to omnichannel projects for Decathlon and Auchan. A graduate in AI and IT systems strategy, he excels in innovative tech solutions.

Funding 💰

Total Funding Amount: ~€1 million*

Last Valuation: €50.5 million

*Note: The team reports that over €1 million has been raised since 2021, supported by +80 investors and business angels.

Business Model 🧩

Value Proposition

Mizen offers a halal digital account tailored to Muslim ethics, addressing a gap in Islamic finance for everyday financial needs. It ensures zero-interest operations, transparency, and Sharia compliance, providing an ethical alternative to conventional banking. With inclusive pricing and accessibility, Mizen empowers underserved Muslim communities in Europe with values-aligned financial services.

Sharia compliance refers to adherence to Islamic laws, which prohibit practices like charging or earning interest (riba) and investing in unethical industries. For Muslims, this ensures financial dealings align with their faith and values, fostering trust and enabling access to ethical financial services that conventional banks often overlook.

Customers

Mizen serves primarily Muslim individuals across Europe who seek ethical, Sharia-compliant financial solutions that are free from interest. These customers value transparency, security, and accessibility, preferring services without hidden fees or unethical practices. Addressing significant pain points, the company provides an inclusive alternative to conventional interest-based banking and limited halal investment options, meeting the needs of a largely underserved demographic in the Islamic finance sector.

Offering

A fully Sharia-compliant app-based checking account that includes a debit card for seamless payments and cash withdrawals, having the ability to perform SEPA transfers with ease and transparency.

Monetization

Subscription plans

Freemium model, offering basic or limited features for free and charging users for additional transactions.

Operations

Mizen operates in France under ACPR regulation by the Banque de France, which permits expansion to other European markets.

Market Size 🌍

The European fintech market is witnessing robust growth, with a market size of €83.6 billion in 2023 projected to reach €393.1 billion by 2032. This growth trajectory, driven by a 21.36% compound annual growth rate (CAGR), underscores the increasing adoption of digital financial solutions across Europe. Within this context, Mizen addresses a significant niche market: the underserved Muslim population seeking financial services aligned with Sharia principles.

With over 5% of Europe’s population identifying as Muslim in 2023, the market for Sharia-compliant financial products, such as Mizen’s halal digital account, is valued at approximately €4.18 billion. This figure is set to grow significantly as Europe’s Muslim population is expected to rise to 8% by 2032, increasing the Muslim-focused market size to an estimated €31.45 billion. This growth, combined with the broader fintech sector’s expansion, presents a unique opportunity for Mizen to establish itself as a leading provider in this ethical and value-aligned space.

Mizen’s commitment to zero-interest operations, transparency, and Sharia compliance directly addresses the financial needs of Europe’s expanding Muslim population, which is often overlooked by traditional banks. This focus not only builds trust within the community but also leverages a rapidly growing €31.45 billion market opportunity, showcasing how ethical innovation can drive both business growth and financial inclusion.

Competition 🤼♂️

Lina Finance

Lina Finance, a France-based halal wealthtech startup, specializes in Sharia-compliant investments, offering life insurance, private equity, sukuk, and real estate opportunities tailored to ethical finance principles. It operates under a licensed partnership model but doesn’t provide checking accounts.

Revolut

Revolut, a UK-based fintech, serves 50+ million users across 40+ countries under UK and EEA banking licenses. It excels with multi-currency accounts, stock and crypto trading, and travel perks like fee-free currency exchanges.

Laymoon

Laymoon, based in France, offers Halal financial services by partnering with licensed institutions. It provides a Sharia-compliant digital account for paying, sending, and receiving money while adhering to Islamic principles. With an independent Sharia Supervisory Officer overseeing compliance, Laymoon ensures its products are ethical and accessible. Though currently focused on France, it’s gaining traction among users seeking Islamic finance solutions without banking status.

Musc Pay

Musc Pay, based in Belgium, is a Sharia-compliant fintech app offering users a certified Halal account, IBAN, and payment card. Licensed under IFAAS, it promotes zero interest, overdrafts, or speculation. Users can manage finances, make transfers, and withdraw cash globally.

Competitiveness 💪🏼

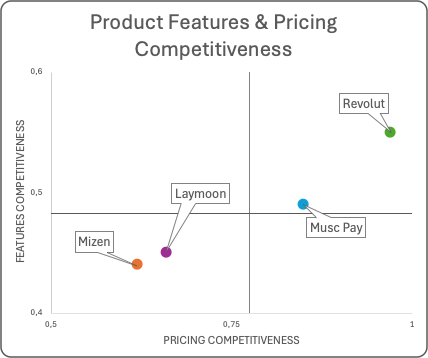

Mizen operates in a niche market, focusing on providing halal checking accounts, a feature that distinguishes it from mainstream fintechs like Revolut. However, within the halal fintech ecosystem, Mizen’s competitiveness is mixed. It offers basic banking services, such as SEPA transfers, physical and virtual cards, and cash withdrawals, but these features are not differentiated from its competitors like Laymoon or Musc Pay. While it maintains relevance among halal-focused fintechs, its high pricing on debit card purchases, cash withdrawals, and other basic features reduces its overall attractiveness.

When compared to Musc Pay, Mizen falls short in both features and pricing. Musc Pay offers a broader range of digital banking and savings tools, including sub-accounts and budgeting, at significantly lower costs for fundamental services. Even Laymoon, with its cashback program, manages to edge out Mizen in terms of added value, although it too has pricing challenges. Among halal fintechs, Mizen’s primary advantage lies in its relatively valuable monthly fee structure, but this is undermined by higher transaction costs.

On a broader scale, comparing Mizen to Revolut highlights its limitations. Revolut, while not halal-focused, is far more robust in features and pricing, which has made it an appealing alternative even for Muslim users in France, where halal banking options are limited. Mizen, like its halal counterparts, struggles to compete against mainstream fintechs offering superior functionality at lower costs.

In conclusion, Mizen holds a niche position within the halal fintech space but needs significant improvements to stand out. Reducing transactional fees and introducing more advanced digital banking features would enhance its competitiveness. While it meets a specific need, its current offering is unlikely to attract users seeking value and innovation comparable to mainstream alternatives.

Roadmap 🧭

Launch Halal Real Estate Platform, allowing users to invest without Riba.

EU Expansion: Belgium, Spain, Germany, Italy.

What we like 👍

Founding Team: CEO’s banking expertise and CTO’s IT background provide a balanced leadership foundation.

Customer Base: Reaching 19,000 clients demonstrates notable traction within a niche market.

Monetization Strategy: Prioritizing quality clients over quick growth fosters stability and sustainable development.

Fintech Potential: Sector growth projected at 21.36% CAGR to €31.45 billion by 2032 reflects opportunity.

Early-Market Entry: Establishing in the halal financial segment offers a unique first-mover advantage.

What we don’t like 👎

Non-Halal Competition: Larger fintechs like Revolut could easily adapt and dominate by offering halal account services.

Halal Rivals: Competing with Musc Pay and Laymoon, Mizen is struggling to stand out in offerings.

Halal Viability: Growing secularism among European Muslims raises questions about demand for halal financial services.