This Thursday, we’ll take a look at inbestMe, which is launching its Equity Crowdfunding Campaign at Crowdcube platform. Expect a 7-minute read, and please note this is not financial advice.

Founding Team 👨🏼💻

Jordi Mercader, Founder & CEO: With a foundation in Finance from ESADE, a 13-year tenure at Burberry and Co-founder of Bodi.Me Jordi Mercader transitioned from Managing Director roles to launch inbestMe in 2014. As a visionary in automated portfolio management, he brings rich expertise from his roles across finance, product, and operations, particularly within the apparel and luxury sectors.

Lluís Valero Borras, Co-Founder & CFO: Lluís brings a robust background in financial oversight from roles at TALENTA, Caixa Catalunya, and Banco Popular, focusing on asset management, regulatory compliance, and risk governance. Skilled in fintech, unit economics, and MIFID, he holds an EMBA from EAE and advanced certifications in financial planning and control.

Ferad Zyulkyarov, Co-founder & CTO: Ferad combines deep technical expertise with leadership experience across fintech, high-performance computing, and automation. Before InbestMe, he led large EU research projects on supercomputing at the Barcelona Supercomputing Center and pioneered resilient software solutions at Intel, holding six patents. He holds a PhD in Computer Architecture.

Funding 💰

Investors

GVC Gaesco: €1.3 million (2019)

AI Grant: €128k (2019)

Mutual Médica and GVC Gaesco: €1.01 million (2020)

Undisclosed investor: €953k (2021)

EU Grant: €314k (2022)

Equity Crowdfunding (Crowdube): €2.24 million (2022), €2 million from a single investor

Equity Crowdfunding (Crowdube): €24.5k (2023)

Total Funding Amount: €5.97 million

Last Valuation: €25 million

Business Model 🧩

Value Proposition

InbestMe offers a highly personalized, low-cost robo-advisor for investors seeking simplicity, transparency, and independence. It customizes diversified ETF portfolios based on individual goals and risk profiles, automating rebalancing to enhance returns. Unlike traditional advisors, it provides flexible plans with lower fees, contributing to more profitable, goal-oriented investing.

Customers

Serves individual investors seeking low-cost, flexible, and automated portfolio management. They value ease, transparency, and options like sustainable investments, addressing pain points of high fees and complex processes.

Offering

Hybrid Robo-Advisor: Integrates algorithm-driven portfolio management with expert human oversight for a balanced approach.

Diverse Investment Options: Offers access to ETFs, bonds, and index funds, enabling broad market exposure.

Cash Management: Includes money market fund investments to earn returns on cash holdings.

Retirement Planning: Supports long-term savings through structured pension plan options.

Kids Accounts: Provides tailored investment accounts designed for minors.

Extensive Portfolio Selection: Features over 100 customizable portfolios to suit varying investor preferences.

Goal-Based Investing: Adapts investment strategies to align with individual financial goals.

Personalized Approach: Combines automated tools with human insights for a customized investment experience.

Monetization

Management fees based on assets under management (AUM) and selected investment plan.

Operations

InbestMe’s services are available globally, with clients in over 65 countries across all continents. While their reach is broad, the majority of their clients reside in Spain.

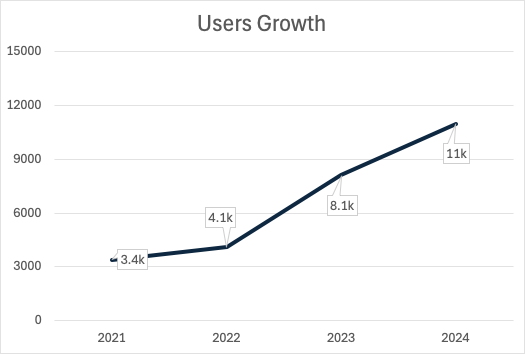

Growth 📊

Credentials 🏅

Secured EU research grants for innovative SMEs and AI Grants.

Utilizes Interactive Brokers’ infrastructure

Market Size 🌍

The wealthtech industry, merging technology with wealth management, is set for rapid expansion, with market size projected to grow from an estimated $5.43 billion in 2023 to $24.92 billion by 2033. These figures, derived from multiple reports and high-level estimations, reflect a compound annual growth rate (CAGR) of 16.46%. This growth signals a significant shift as wealth management becomes increasingly digital, personalized, and accessible.

Key drivers include the digitalization of financial services and shifting consumer preferences, particularly among tech-savvy, younger generations. Wealthtech platforms cater to these preferences by offering convenient, customizable options like robo-advisors. Advances in AI, machine learning, and blockchain further enhance platform capabilities, enabling more personalized recommendations and secure management. Meanwhile, the demand for sustainable investing solutions aligned with ESG values is boosting interest in wealthtech.

Overall, the wealthtech industry reflects a global shift to digital finance, democratizing access to financial tools and aligning with modern investment trends through 2033.

Competition 🤼♂️

Indexa Capital

Indexa Capital, a Spanish robo-advisor, targets EEA, UK, and EFTA residents, offering tailored portfolios and pension funds at a low fee. Its model focuses on highly diversified index fund portfolios. Serving 90k clients and managing €2.8 billion in assets, it has a strong reputation for transparency and low costs.

Finizens

Finizens, based in Spain, specializes in low-cost, passive investment strategies focused on ETFs and mutual funds, exclusively for Spanish residents. Known for its hands-off approach and minimal fees, it has attracted over 21,290 clients and currently oversees €400 million in assets, positioning itself as a cost-efficient option in Spain’s wealth management scene.

Scalable Capital

Scalable Capital, headquartered in Germany, offers automated investment management and trading services, accessible across Germany, Austria, Spain, Italy, the Netherlands, and France. Backed by powerful AI-driven risk management, Scalable Capital now serves 1 million clients, managing €20 billion in assets.

Moneyfarm

Moneyfarm is a UK-based digital wealth manager licensed to operate in the UK and Italy. Focused on long-term, diversified investment solutions, it provides personalized portfolios using ETFs, with support from real advisors. With over 130k active investors, it manages more than £4 billion in assets.

Competitiveness 💪🏼

InbestMe positions itself competitively within the WealthTech space, particularly through its client-centric advisory services and educational approach, which help differentiate it as a provider focused on customer empowerment. With over 100 portfolio options, InbestMe’s offerings reflect a high level of customization, allowing clients to invest according to specific goals, select particular portfolios, and enjoy tailored options that can meet diverse investment objectives. However, despite this wide array of options, InbestMe falls behind in terms of unique features that could distinctly set it apart from its competitors.

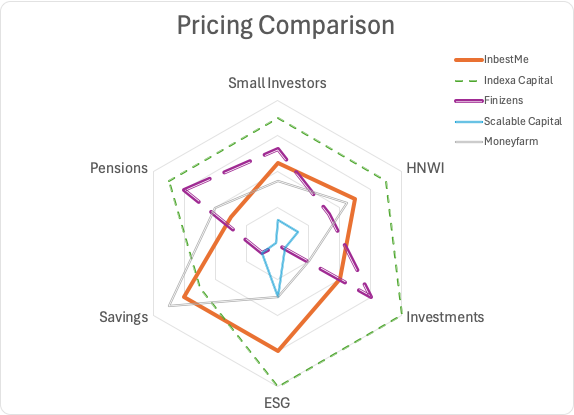

On pricing, InbestMe is reasonably competitive, ranking second overall, just after Indexa Capital. Its pricing structure is particularly appealing in the ESG and Savings segments, although it’s not the most affordable choice in any segment. The platform’s pricing strategy appears to prioritize high-net-worth individuals (HNWI) more than smaller investors, positioning it as an attractive choice for clients with larger portfolios, while smaller investors may find more competitive alternatives elsewhere.

Despite these strengths, InbestMe faces challenges in competing with leaders like Indexa Capital, which combines simple yet diversified offerings with lower pricing across most segments. While InbestMe offers more portfolio options and greater customization than Indexa, it struggles to justify a significantly distinct value proposition. Other competitors, such as Moneyfarm and Scalable Capital, lead in areas like thematic portfolios, tax-efficient schemes, and accessibility, which also contribute to a richer feature set.

To boost competitiveness, InbestMe could expand its offerings with options like commodities and cryptocurrency, catering to broader investor preferences. Integrating AI-driven robo-advisors would also help lower costs, enabling more competitive pricing. Additionally, adding B2B and B2B2C services, as Indexa Capital and Moneyfarm have done, would open new revenue streams in institutional markets. Lastly, introducing loan products, like Scalable Capital, could give InbestMe an edge in Spain by offering unique options not yet covered by direct competitors.

Roadmap 🧭

Broader Financial Advisory Services: Provide more tailored planning support.

Trading Capabilities: Enabling trading tools to clients (DIY).

White-Label Solutions: Allow partners to rebrand core services.

Insurance and Credit Options: Introduce insurance and lending services.

Digital Wealth Management: Offer streamlined, accessible private banking.

What we like 👍

Experienced Founding Team: Led by a second-time Founder & CEO with co-founders seasoned in banking, fintech, and investment services.

Service Expansion Goals: Aims to diversify offerings, adding white-label options for stable, recurring revenue.

Technology Recognition: Secured EU and AI grants, highlighting tech capabilities and team expertise.

Market Demand Growth: Automated investment interest projected to rise 16.46% by 2033, reflecting stronger sector demand.

Exit Potential: While an IPO may be less likely, acquisition by a major player, such as a legacy bank or a digital banking company, remains a strong possibility.

What we don’t like 👎

Lack of Product Differentiation: Offers no clear standout feature beyond competitive pricing, which isn’t market-leading.

Low Market Presence: Holds the smallest user base and AUM compared to direct competitors.

Decline in AUM and Revenue: Unexplained revenue and AUM decline from 2021 to 2022 raises concerns.

Slower User Growth: Pace of new user acquisition slowed between 2023 and 2024.